At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

Twenty-four years ago, Virginia homebuyer Susan S. thought she’d purchased her forever home.

However, a divorce upended the plan to live out her days in the shade of the Bigtooth Maple trees that surrounded her family home. After nearly a year of living in a rental with her daughter, Susan is ready to move into a home that will serve as the backdrop for a new, more independent life.

Five hundred miles away, 28-year-old Connecticut homebuyer Corrine W. is basking in the joy of an impending marriage to her longtime boyfriend. The couple has raised a down payment fund, locked in a mortgage rate, and are eager to find the home where they’ll raise their future children.

Although Susan and Corrine — both of whom spoke to Inman on conditions their last names weren’t used — are more than ready to start their next chapters, their markets have raised obstacle after obstacle. Scant inventory, erratic mortgage rates and exorbitant home prices have both women racing toward the finish line in fear the market will take another unprecedented turn.

“I’m hoping that if I ride out the next month or so, I will have more opportunities as it transitions into the summer market and be able to find something a little bit more doable,” Corrine said. “But the other worry is with interest rates dropping more, more people are gonna have more and more wiggle room, which will put them in my budget competition anyways.”

“It almost feels like a crapshoot at this point,” she added.

While mortgage rates are the source of Corrine’s anxiety, Susan said the possibility of paying a buyers’ agent commission is pushing her to secure a home before July — the tentative deadline for the changes outlined in the National Association of Realtors’ proposed settlement.

“The commission would probably be about 3 percent. That’s a significant chunk of change and obviously might cut into what you had available for a down payment or other costs,” she said. “The last time I was in the market was more than two decades ago. I’ve never done this on my own.”

“I’m 63,” she added. “I want to go ahead and do it. I don’t want to wait any longer. I need to get on this. Everything just seems crazy in real estate right now.”

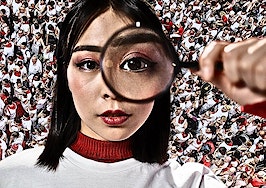

Below, take a look at Susan and Corrine’s homebuying journeys through the numbers that have guided their decisions.

The elusive listing price: $325,000

For Susan and Corrine finding an affordable home has been like finding a needle in a haystack. Both women came into the market hopeful they’d be able to find a starter home for around $325,000 — a number that would yield a monthly mortgage equal to or barely above their current monthly housing costs.

“I started out pretty realistic with my budget. I’ve always been kind of a pragmatic person,” Corrine said. “I know, rationally, my dream home would’ve been $400,000 pre-pandemic. Now it’s probably $600,000 to $800,000.”

Corrine would’ve been closer to purchasing her dream home if not for a mishap that sliced her loan approval amount by six figures. As a school counselor and independent psychotherapist, Corrine made an annual income that qualified her for a loan topping $450,000 — that was until the loan officer had to reconfigure the approval amount after learning her psychotherapy practice was less than five years old.

Corrine would’ve been closer to purchasing her dream home if not for a mishap that sliced her loan approval amount by six figures. As a school counselor and independent psychotherapist, Corrine made an annual income that qualified her for a loan topping $450,000 — that was until the loan officer had to reconfigure the approval amount after learning her psychotherapy practice was less than five years old.

“They take the average of your income unless you’ve been in private practice for five years,” she said with a tinge of lingering disappointment. “I’m making significantly more but because they have to take that average, [the approval amount] dropped by like 100 grand.”

That drop has severely limited Corrine’s choices in the market.

Two weeks ago, she found a fixer-upper listed at $310,000 and, aware of the competitive nature of the market, decided to offer $350,000. However, Corrine quickly retracted the offer after learning the home had a 70-year-old cesspool instead of a modern septic system — a project that could cost them another $20,000.

“That was just not doable,” she said.

Susan, a longtime educator, had a smoother mortgage approval process; however, she’s found it difficult to stop comparing today’s market to her last purchase in 2000.

“The number of houses on the market like two decades ago … there were tons of houses on the market. There were lots of choices,” she added. “Prices, of course, were a lot more reasonable. Interest rates weren’t, but they are now.”

In the National Association of Realtors’ latest existing-home sales report, median home prices rose 5.7 percent year-over-year to $384,000. That’s a 135 percent increase from the median sales price during the first quarter of 2000 ($163,500), according to the U.S. Census Bureau.

In the National Association of Realtors’ latest existing-home sales report, median home prices rose 5.7 percent year-over-year to $384,000. That’s a 135 percent increase from the median sales price during the first quarter of 2000 ($163,500), according to the U.S. Census Bureau.

Meanwhile, the 30-year fixed-rate average for mortgages between both eras is strikingly similar. February 2024 ended with an average of 6.94 percent — a 19 percent difference from February 2000 (8.31 percent). Although mortgage rates were slightly higher in 2000, the difference in home prices means the average mortgage payment has risen 40 percent from $1,511 to $2,116.

“There’s not a lot of houses and there’s a lot of competition for them,” she said. “You have to keep raising your amount to try to outbid other buyers. It feels a lot more competitive than it did then.”

Susan said she prizes a walkable neighborhood with plenty of nearby amenities, ample gardening space, two bedrooms and two bathrooms, and a dedicated dining room to entertain her family and friends. However, she said she’s been hard-pressed to find a home that meets all her needs for $325,000.

“I think that, realistically, I might have to go up to $350,000,” she said. “I’m still looking in that $325,000 range, but there’s a real difference in the houses that are on the market in those two price ranges.”

The amount of time to make a decision: 24 hours

The heyday of bidding wars has moved to the background for most agents and consumers, as the median days on market for the U.S. reached 43 days in late March. That’s a big turnaround from March 2021, when the median days on market dipped to 25 days.

However, Corrine and Susan said the current sales pace has given them whiplash.

In January, Moody Analytics estimated the housing market is short 1.5 million to 2 million housing units nationally. Meanwhile, the gap for detached, single-family homes is 1.1 million to 1.2 million units.

The specific numbers for Virginia and Connecticut — Susan and Corrine’s home states, respectively — are hard to pin down. However, studies by Pew Trust and the Connecticut Housing Finance Authority estimate both states are short by at least 100,000 homes.

“The market here is so competitive,” Corrine said. “Something will come on the market at my budget, and by the time I go to see it 24 or 36 hours later, there are already five plus offers on it. They’re all well over asking and some of them are all cash.”

Susan has had a similar experience with homes on her wish list going under contract in a matter of days. That trend has pushed her to finally choose a buyer’s agent after months of scrolling on Realtor.com, Zillow and Trulia and doing neighborhood drive-thrus.

“I’m still concerned about finding an agent. I know that’s a huge piece of the puzzle,” she said. “I’m not a fast decision-maker, and I know I might have to be. In this market, he who hesitates is lost.”

“Everything is going so fast,” she added. “Like there’ll be something that’s new, and just as soon as you see it, it’s already pending. It’s been on the site for five hours or whatever and it’s gone. That concerns me.”

The number of months to get a deal done: 3

Concerns about inventory, affordability and increased competition if the Federal Reserve follows through on dropping rates in June have Corrine and Susan on the edge. Both women said they’d like to make a purchase within the next six months; however, June or July would be ideal.

“The inventory in this area is the lowest it’s been in 20-some-odd years. It’s kind of unprecedented. It’s crazy,” Corrine said. “I’m also hoping that if I ride out the next month or so, I will have more opportunities as it transitions into the summer market and be able to find something a little bit more doable.”

In a January 2023 Inman article, Zillow Senior Economist Orphe Divounguy explained the impact of mortgage rates on buyer activity. “The research shows a one percentage point increase in mortgage rates will lower housing sales by roughly 5 percent to 10 percent,” he said.

The power of mortgage rates has been on full display in 2023 and 2024. During the first week of March, mortgage rates dropped to 7.02 percent and sparked an 11 percent week-over-week increase in mortgage rate applications. The rally in mortgage rate applications was short-lived, as the average 30-year fixed rate climbed 36 basis points month-over-month.

Susan is less concerned about mortgage rate trends, as she experienced a market with rates of more than 8 percent in 2000.

“I’m trying not to stress out too much over the mortgage rates,” she said. “I think they’re going to do what they’re gonna do over the next couple of months.”

“I also figure I’m planning on staying in whatever home I purchase long term,” she added. “I know I can always refinance if I need to in the future.”

The (potential) commission cost hanging over their heads: 3%

In addition to the worries of finding a suitable listing, sticking to a reasonable budget, and potentially competing with a crop of new buyers this spring and summer, Corrine and Susan are considering the impact of recent buyer-broker commission lawsuits on their homeownership plans.

The National Association of Realtors sent shockwaves through the industry in March with the decision to settle several buyer-broker commission lawsuits, including Sitzer | Burnett.

The settlement, which still awaits approval by the courts, includes a $418 million payout and the overturning of the cooperative compensation rule. The settlement also states MLS participants must have their buyers sign a written buyer representation agreement before touring homes.

If the terms are accepted, these changes could go into effect in July — the time Corrine and Susan plan to make a purchase. Both women said they’ve read articles about Sitzer | Burnett, the settlements, and the uncertain future it creates for homebuyers who’ve been used to the seller covering commission costs.

“I know about it, but I’m not overly concerned at this point,” Corrine said. “There’s so much to be worried about at this point, that that’s kind of one of those things where it is what it is. And if it impacts me, I’ll deal with it when I get to it, but at this point, it’s just about finding something.”

Susan wasn’t as nonchalant as Corrine regarding commissions. As someone who’s bought and sold before, she said she understood both sides of the buyer-broker commission debate. She also said she’s fully aware of the way the settlement terms could play out — a seller could still decide to take on the full commission cost or she could be left to negotiate and pay the commission on her own.

“[The settlement] had me thinking maybe [it] was going to be a good time [to buy] because I might be able to get in there before everything happens,” she said. “But I also wonder if some people are going to hold off putting their houses on the market because they might benefit from only paying their selling agent’s commission.”

If she needs to pay a buyer’s agent commission, Susan said she’s prepared to negotiate and would likely fund the commission with her down payment fund. However, she’d like to avoid that scenario as the down payment is key to keeping her monthly mortgage payments low.

“I know that it’s still one of those things that you might be able to negotiate somewhat with sellers,” she said. “I feel like it’s kind of in flux, and nobody really knows what’s gonna happen. It’s all brand new, and over the next year or two, the market will probably fall into some sort of pattern. But right now, it’s kind of like the Wild West.”

The 1 thing that matters most

As they look toward the horizon, Corrine and Susan said there’s one agent characteristic they’re counting on: honesty.

“My agent has actually been one of my closest friends for around a decade,” Corrine said. “She’s incredible, not only because she’s very good at her job, but she looks out for me. I could show her something, and she’ll look at me and say, ‘Absolutely not.'”

She said her friend-turned-agent’s honesty has helped her wade through months of missed listings, failed or retracted offers, and mortgage rate changes. “I’m cautiously optimistic about the future,” she said. “I know homeownership comes with plenty of surprises. But I’m very lucky to have people in my corner who will absolutely break that down with me, so I know what I’m fully getting into.”

Meanwhile, Susan is still on the hunt for an agent. She said she would prefer to work with someone who specializes in working with older homebuyers and understands what’s needed to successfully age in place.

“I’m not like a buyer who’s younger and may want to start a family,” she said. “When I say I want a first-floor bedroom, that’s really important to me — I’m planning on living here for, you know, 20 or 30 years. This will be my last home.”

Even if she can’t find an agent who specializes in helping older buyers, Stubbs said she’d be OK as long as the agent is honest and can clearly explain the coming challenges in the market.

“I just want a Realtor who is upfront and shares as much information as possible,” she said. “Something I find a lot of times with professionals is they’re so used to their job and they have such knowledge; they forget the people they’re dealing with don’t do this all the time.”